BTC OMG

Week in and week out the most popular question that I field is “what’s my take on” (insert currency name here) which depends on the main headline driver of that particular week. Last week was no different, except for the fact that the currency in question isn’t issued by country in the world. If you haven’t figured it out yet, I’m speaking of Bitcoin (BTC). Some media outlets refer to it as a currency, although most people that buy it never use it to purchase anything with it. Others refer to it as digital gold, which if you are a gold holder like myself actually makes you cringe – I rather have real gold that’s been used for over 5,000 years as a store of wealth than digital gold which is useless if there’s no electricity – hey, but that’s just me. Another term used to describe BTC is cryptocurrency. I don’t like using this term because there are over 1,324 (and growing) cryptocurrencies and most of them are not intended to be used as currencies – they are actually token, which like equities represent a share of ownership. I think the best way to describe BTC would be as a crypto asset.

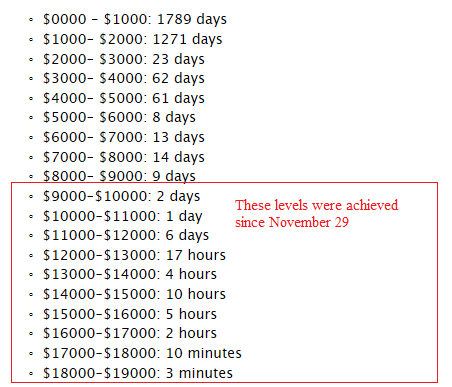

Here’s why it has everyone’s attention, this is how long it has taken BTC to cross the key psychological levels:

This brings to mind that phrase "irrational exuberance" that the then-Federal Reserve Board chairman, Alan Greenspan, used in a speech to describe the unsustainable investor enthusiasm of the dot-com bubble of the 1990s. Insane? Yes, greed knows no bounds but the policymakers are the enablers – what should we expect in a world filled with ZIRP (zero interest-rate policy), NIRP (negative interest rate policy), and QE (quantitative easing – a fancy term for money printing) – need I say more.

Don’t get me wrong, I’m a big believer in the blockchain technology behind these tokens and I’ve personally invested in some of them. The blockchain will transform industry and commerce on a similar scale as the Internet has. I just don’t think anyone should commit new money into these tokens at these elevated prices. So if you are interested in getting involved I would encourage you to open an account with a crypto exchange and only buy into them at significantly lower prices after the inevitable blow-off top.

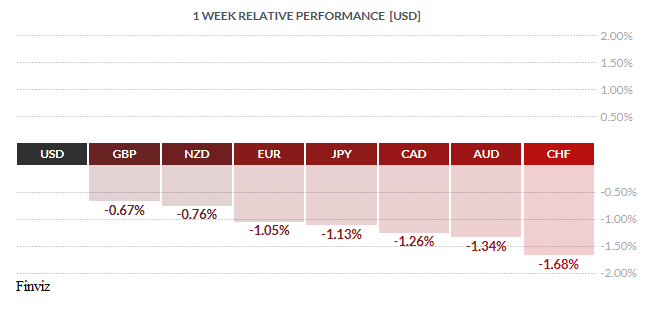

In the actual currency market, the USD was the clear winner last week even though the week’s most anticipated headlines came from elsewhere, Canada and the UK. The Bank of Canada held interest rates steady at 1%, as expected, but they displayed enough caution to dampen expectations for a hike early next year. Their caution was a real surprise to Mr. Market after a much stronger-than-expected November jobs report released the previous Friday. Those numbers were followed up with a much better trade picture as Canada's trade deficit shrank to a five-month low in October, buoyed by an encouraging rebound in recently slumping exports. Meanwhile, November housing starts posted their best post-recession level (252,184) which help to lift the 12-month average to a new cycle high of 220,230 units. This was all for naught, as the BOC decided to look past the recent data improvements and instead focused on moderating growth, considerable trade and geopolitical uncertainty, and the ongoing slack in the labor market. Based on this, Mr. Market dialed back its expectations for a rate hike in January to 28% from 41% before the announcement causing the CAD to fall almost two cents on the day. The CAD is stuck in its trading range since mid-October between 1.2950 and 1.2620

The other big story last week was the breakthrough in the Brexit negotiations. Finally, after countless fits and starts, the UK and the EU have agreed on a divorce settlement. The three remaining stumbling blocks were the rights of EU and UK citizens, the Irish border, and the monetary divorce payment. I’m going to be a little cynical here, but with the UK agreeing to pay the EU around 45 billion euros, the EU miraculously found a way to compromise on citizen rights and accept a pledge from the UK to provide specific solutions to address the unique situation of Ireland and a promise that, in the absence of an Irish border deal, the UK will maintain full alignment with the single market and customs union. I guess “money talks” and the EU has decided that "sufficient progress" has been made in order to advance the negotiations to the next level – the trade agreement.

The US index managed to put together its first five day advance since February on the back of increased expectations of a tax reform bill being hammered out between Congress and the Senate, talk of an infrastructure initiative, and continued supportive economic data ahead of this week’s Fed decision. There is zero chance that the Fed will not raise interest rates at this week’s meeting. In fact, by doing so, it will mean that the Fed will do exactly what they spelled out to do in the dot plots at the beginning of the year, which is to raise interest rates three time in 2017. This lends credence to their assertion that they intend to raise rates three more time in 2018. Also with at least 13 central bank meetings this week, and the Fed the only one that will hike rates, the monetary divergence meme will be front and centre. Having said this, one would expect the USD to rise but don’t be surprised if it falls on the rate announcement given that tax reform bill is not finalized and that Congress just passed a stopgap spending bill to prevent a government shutdown this weekend that keeps the government running through December 22nd.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, DECEMBER 11 | ||||

| TUESDAY, DECEMBER 12 | ||||

| 02:00 | GBP | Bank Stress Test Results | ||

| 02:30 | GBP | BOE Gov Carney Speaks | ||

| 10:00 | USD | CB Consumer Confidence | 123.9 | 125.9 |

| 10:00 | USD | Fed Chair Designate Powell Speaks | ||

| WEDNESDAY, DECEMBER 13 | ||||

| 04:30 | GBP | Average Earnings Index 3m/y | 2.5% | 2.2% |

| 08:30 | USD | CPI m/m | 0.4% | 0.1% |

| 08:30 | USD | Core CPI m/m | 0.2% | 0.2% |

| 10:30 | USD | Crude Oil Inventories | -5.6M | |

| 14:00 | USD | FOMC Economic Projections | ||

| 14:00 | USD | FOMC Statement | ||

| 14:00 | USD | Federal Funds Rate | <1.50% | <1.25% |

| 14:30 | USD | FOMC Press Conference | ||

| 19:30 | AUD | Employment Change | 19.2K | 3.7K |

| 19:30 | AUD | Unemployment Rate | 5.4% | 5.4% |

| 21:00 | CNY | Industrial Production y/y | 6.2% | 6.2% |

| THURSDAY, DECEMBER 14 | ||||

| 03:30 | CHF | Libor Rate | -0.75% | -0.75% |

| 03:30 | CHF | SNB Monetary Policy Assessment | ||

| 04:00 | CHF | SNB Press Conference | ||

| 04:30 | GBP | Retail Sales m/m | 0.4% | 0.3% |

| 07:00 | GBP | MPC Official Bank Rate Votes | 0-0-9 | 7-0-2 |

| 07:00 | GBP | Monetary Policy Summary | ||

| 07:00 | GBP | Official Bank Rate | 0.50% | 0.50% |

| 07:45 | EUR | Minimum Bid Rate | 0.00% | 0.00% |

| 08:30 | EUR | ECB Press Conference | ||

| 08:30 | USD | Core Retail Sales m/m | 0.7% | 0.1% |

| 08:30 | USD | Retail Sales m/m | 0.3% | 0.2% |

| 08:30 | USD | Unemployment Claims | 236K | |

| 12:25 | CAD | BOC Gov Poloz Speaks | ||

| FRIDAY, DECEMBER 15 | ||||

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |