Politics As Usual

Last week was a slow week for market players, with a dearth of hard economic news, unsurprising economic statistics and unremarkable central banker speeches. Such a situation allows politics to take centre-stage which, as we have mentioned in prior articles, is both irksome and, even worse, unpredictable.

The week started with the release, by the Bank of Canada, of its quarterly Business Outlook Survey. It painted a picture of a strong domestic economy with firm investment and hiring intentions. This was after the huge run-up in jobs in Canada’s most recent employment report and largely confirmed, in the eyes of most traders, that the BOC will raise its trendsetting rate on January 17th. Among other things, companies claimed to have difficulty keeping up with demand, reportedly the highest since the 2008/9 recession. All this was sufficient to send the loonie higher, as Mr. Market took the currency up almost a full cent against the greenback.

That was fine until last Wednesday, when one of the Canadian negotiators at the current NAFTA talks remarked that America might indeed pull out of the massive trade agreement. CAD dropped over a cent on the news for obvious reasons. At the same time, Canada filed a complaint with the World Trade Organization over restrictive American trade practices (anti-dumping &c.) which have long been a source of irritation to Canadian exporters. This may be a negotiating gambit by Canada in advance of the upcoming Montreal Round of talks on January 23rd or perhaps not. Regardless, Canada is taking an unusually hard line and making it clear that she, too, has issues with NAFTA. (Negotiate with Trump / Negotiate like Trump)

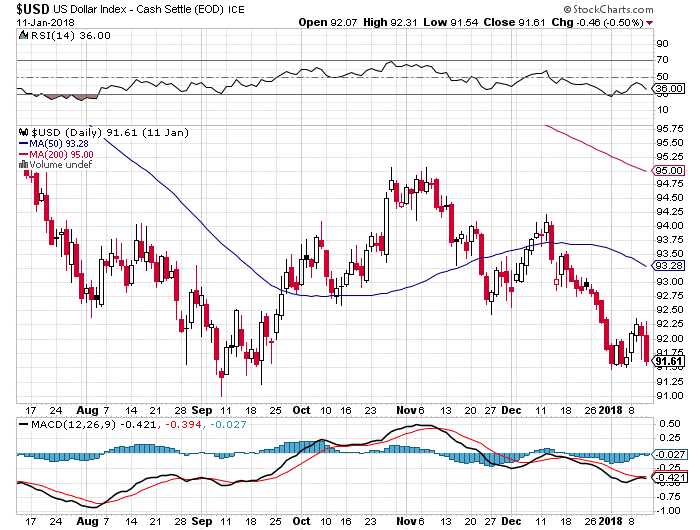

US Dollar Index - How Low Can You Go?

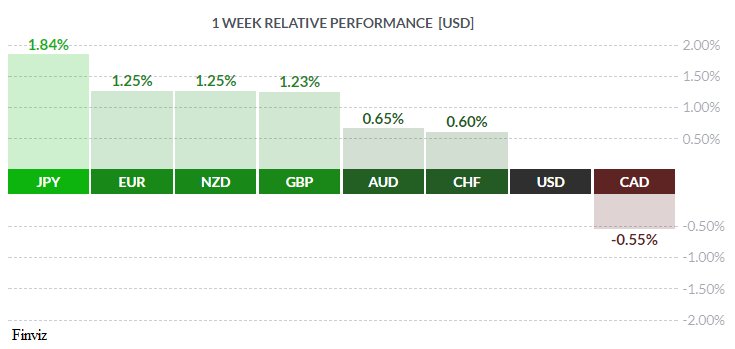

While CAD ended up the nominal loser on the week, in reality USD was the real loser. Again with the politics: China announced that it was reviewing its purchases of US treasury bonds, which led to a sell-off in the USD on fears of rising bond yields.

EUR rallied sharply on news that a coalition has been achieved in zone paymaster Germany, whose political instability since last September’s inconclusive elections had darkened somewhat the outlook for the EUR. Further support came from rather more hawkish remarks from the ECB on inflation

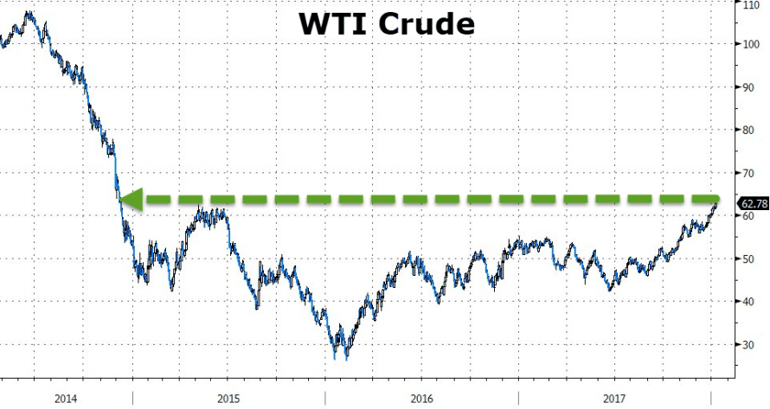

We haven’t taken a look at oil in some time – que pasa, bro?

Courtesy ZeroHedge

Courtesy ZeroHedge

Is The Bear Market Over?

Crude has been the beneficiary of some rather positive recent developments. OPEC and its non-OPEC allies led by Russia managed to stick together for all of 2017, showing a level of market discipline and compliance often lacking in the past. Both groups have agreed to extend productions cuts/quotas into 2018. The falling USD, as we have explained before, causes commodity prices to rise and crude is no exception. (This may eventually work to Canada’s benefit although, at current levels, oilsands crude is still barely profitable). Collapsing crude production in Venezuela and possible supply disruption in Iran would certainly see crude prices rise, but might also increase the temptation for members to, shall we say, export more crude than they should in a rather secretive fashion.

Rising prices would also encourage American frackers to raise production – in fact, the U.S. Energy Information Administration predicts that America will be producing 10 million barrels/day in early 2018, over 10% of global daily production and a level not seen since 1970. As America is a non-member and produces more oil than it needs, this could be a major problem for OPEC in the future.

This week sees the Bank of Canada rate announcement on Wednesday, with little else scheduled for release in Canada. America is closed on Monday, and the balance of the week sees a handful of secondary economic statistics and a pair of Fed speakers.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, JANUARY 15 | ||||

| TUESDAY, JANUARY 16 | ||||

| 04:30 | GBP | CPI y/y | 3.0% | 3.1% |

| 12:00 | CHF | SNB Chairman Jordan Speaks | ||

| WEDNESDAY, JANUARY 17 | ||||

| 10:00 | CAD | BOC Monetary Policy Report | ||

| 10:00 | CAD | BOC Rate Statement | ||

| 10:00 | CAD | Overnight Rate | 1.25% | 1.00% |

| 11:15 | CAD | BOC Press Conference | ||

| 19:30 | AUD | Employment Change | 15.2K | 61.6K |

| 19:30 | AUD | Unemployment Rate | 5.4% | 5.4% |

| THURSDAY, JANUARY 18 | ||||

| 02:00 | CNY | GDP q/y | 6.7% | 6.8% |

| 02:00 | CNY | Industrial Production y/y | 6.1% | 6.1% |

| 08:30 | USD | Building Permits | 1.29M | 1.30M |

| 08:30 | USD | Unemployment Claims | 251K | 261K |

| 11:00 | USD | Crude Oil Inventories | -4.9M | |

| FRIDAY, JANUARY 19 | ||||

| 04:30 | GBP | Retail Sales m/m | -0.8% | 1.1% |

|

by DAVID B. GRANNER Senior FX Dealer, Global Treasury Solutions |