Bend the Knee

A light economic calendar encouraged the currency market to take a back seat to other developments last week. The big intrigue last week was the “bend the knee” meme. We are not speaking of Queen Daenerys’ request that Jon Snow bend the knee in Season 7 of the popular HBO series Game of Thrones. We are also not speaking of NFL players dropping to one knee as a quiet act of defiance and protest during the playing of the national anthem. We are actually referring to the house cleaning at the House of Saud with a stunning purge of high-profile businessmen and government officials under the guise of anti-corruption.

A light economic calendar encouraged the currency market to take a back seat to other developments last week. The big intrigue last week was the “bend the knee” meme. We are not speaking of Queen Daenerys’ request that Jon Snow bend the knee in Season 7 of the popular HBO series Game of Thrones. We are also not speaking of NFL players dropping to one knee as a quiet act of defiance and protest during the playing of the national anthem. We are actually referring to the house cleaning at the House of Saud with a stunning purge of high-profile businessmen and government officials under the guise of anti-corruption.

At least 38 former, current or deputy ministers were arrested on accusations of corruption. The major targets were those who controlled money, the media, or the military. Among those arrested were eleven senior princes, several current or former ministers, the owners of three major television stations, the head of the most important military branch, and one of the wealthiest men in the world - Prince Alwaleed bin Talal, the billionaire businessman who owns 95% of Kingdom Holding, which has a global network of major investments including Citigroup, Twitter, and Apple. To put it in perspective, it would be the equivalent of arresting Jeff Bezos, and the heads of ABC, CBS and NBC in the USA.

By all accounts, the purge was orchestrated by MBS, Prince Mohammed bin Salman, the man most likely to take over upon the death or abdication of his eighty-one-year-old father, King Salman. The move proves that MBS is ready to resort to any means to consolidate his power. This is a new direction for the Kingdom which has ruled by consensus since the death of King Ibn Saud in 1953.

A strange twist to the purge was the resignation of the Lebanese Prime Minister, Saad Hariri. He announced his resignation in Riyadh, on a Saudi TV station citing a threat to his life and meddling in Lebanese politics by Iran and Hezbollah. Hours later, Saudi Arabia accused Lebanon of declaring war against it because of aggression by the Iran-backed Lebanese Shi‘ite group Hezbollah. This development could prove to destabilize the Middle East and pit regional rivals Saudi Arabia and Iran against each other – hence the firm tone in oil and gold this past week.

Speaking of oil, don’t look now but crude is possibly on the cusp of a breakout. Two weeks ago, crude was able to get back above the $55 handle for the first time since the summer of 2015. Last week, it was able to take out the $57 level. If it is able to rise above the lower blue line on the chart drawn from the October 2015 and early 2017 highs then a move to the $62 level is in the cards. Of course, we are reaching here, but if it were to better the second blue line then there isn’t much standing in oil’s way until the $90 level. What could get it there? Well for one, the restarting of Middle East tensions as outlined above could easily get it there – stay tuned.

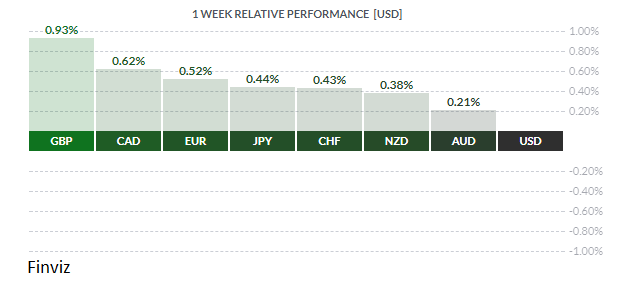

Turning back to the currency markets, with little in the way of economic news the key driver was the on again/off again tax reform bill. In fact, the lack of clarity on the tax reform issue is the only thing that is blurring the lines of the USD’s breakout – Mr. Market can’t decipher whether the USD is simply fraying on the well-worn trading ranges or ready to cement its recent breakout.

As proof of this impasse, the commodity currencies all rallied higher against the USD even though each respective central bank supports the monetary divergence theme last week. Last Monday, the Reserve Bank of Australia left rates on hold for the 15th consecutive month reinforcing that they do not anticipate any change in policy for the foreseeable future. On Tuesday, it was the Bank of Canada’s turn – in a speech BOC Governor Poloz stressed that the bank would remain data dependent and would be cautious in adjusting their policy rate in the future. Lastly, on Wednesday, the Reserve Bank of New Zealand left interest rates unchanged and brought forward their forecast of when they think inflation will reach their target by 3 quarters and the timing of the next rate hike by a quarter to Q2 of 2019. The policy moves and acknowledgments of these three central banks place them firmly in the hold camp and would normally play to the USD’s strength but the USD had to take a knee due to the tax reform ambiguity.

The best performing currency last week was the GBP. Considering it was the worst performer the previous week, after the Bank of England’s dovish rate hike, it should come as no surprise that there would be some give back. The GBP was on its back foot for most of the week as EU negotiators played hardball with the UK. The EU Parliament wasn’t enamoured with the UK’s new offer for EU citizens to appeal a rejection to stay in the Union. The EU believes that nothing should change for its citizens in the UK and for UK citizens in the EU because prior to the vote, citizens were told that nothing would change for those already living and working abroad. However, by the end of the week, their tone changed with PM May’s offer of a bigger divorce payment to the EU to get the talks back on schedule. On Friday, UK Brexit Secretary David Davis and EU chief negotiator Michel Barnier held a press conference in Brussels, following the latest round of talks. While it appeared progress was still slow, both men claimed to have broken ground on some of the key subjects indicating that progress was indeed being made.

In the week ahead, the economic data scheduled for release are unlikely to have policy implications and, may in fact, simply reinforce existing views – that the Fed is on track to hike rate in December and that the ECB and Bank of Japan have not yet changed their policy easing ways.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, NOVEMBER 13 | ||||

| 12:45 | JPY | BOJ Gov Kuroda Speaks | ||

| 21:00 | CNY | Industrial Production y/y | 6.3% | 6.6% |

| TUESDAY, NOVEMBER 14 | ||||

| 04:30 | GBP | CPI y/y | 3.1% | 3.0% |

| 05:00 | EUR | ECB President Draghi Speaks | ||

| 05:00 | GBP | BOE Gov Carney Speaks | ||

| 05:00 | JPY | BOJ Gov Kuroda Speaks | ||

| 05:00 | USD | Fed Chair Yellen Speaks | ||

| 08:30 | USD | PPI m/m | 0.1% | 0.4% |

| WEDNESDAY, NOVEMBER 15 | ||||

| 04:30 | GBP | Average Earnings Index 3m/y | 2.1% | 2.2% |

| 08:30 | USD | CPI m/m | 0.1% | 0.5% |

| 08:30 | USD | Core CPI m/m | 0.2% | 0.1% |

| 08:30 | USD | Core Retail Sales m/m | 0.2% | 1.0% |

| 08:30 | USD | Retail Sales m/m | 0.0% | 1.6% |

| 10:30 | USD | Crude Oil Inventories | 2.2M | |

| 19:30 | AUD | Employment Change | 18.9K | 19.8K |

| 19:30 | AUD | Unemployment Rate | 5.5% | 5.5% |

| THURSDAY, NOVEMBER 16 | ||||

| 04:30 | GBP | Retail Sales m/m | 0.2% | -0.8% |

| 08:30 | USD | Unemployment Claims | 236K | 239K |

| 09:00 | GBP | BOE Gov Carney Speaks | ||

| FRIDAY, NOVEMBER 17 | ||||

| 03:30 | EUR | ECB President Draghi Speaks | ||

| 08:30 | CAD | CPI m/m | 0.1% | 0.2% |

| 08:30 | USD | Building Permits | 1.25M | 1.23M |

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |