Let’s start with the highlights from last week:

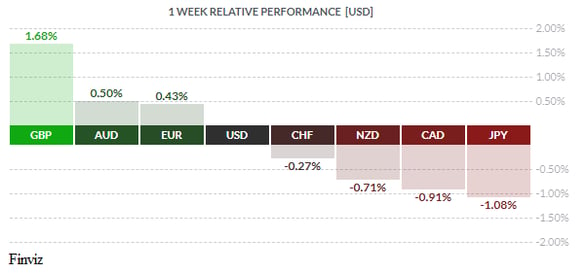

- The GBP was the top performer of the week, briefly rising above 1.25 for the first time since July as the chances of the UK leaving the EU without a deal have faded.

- Italy’s new Prime Minster Conte survived a second vote of confidence, allowing him to form a new government and thus reducing the risk of an Italy-EU confrontation over the budget.

- China removed tariffs from 16 American exports and announced that it would not be adding additional tariffs to US agricultural goods such as soybeans and pork. President Trump agreed to delay tariffs on China by two weeks in October due to the fact China would be celebrating its 70th anniversary as the People's Republic.

- With Hard-Brexit fears receding, a stable Italian government, and Presidents Xi and Trump besties again, the safe-haven JPY was sold last week as risk-on prevailed.

- Rising bond yields last week weren’t a rethink of the path of interest rates and the global economy, but rather more about a falling demand for safety due to risk-on environment.

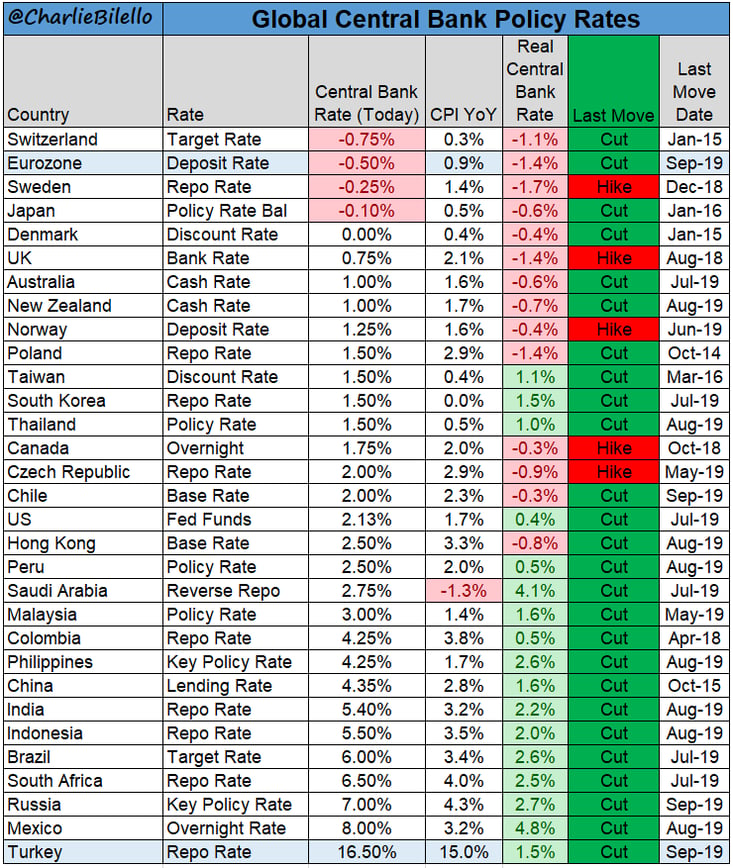

- The main event last week was the ECB policy meeting where they cut deposit rates from -0.10% to -0.50%, introduced a tiering system for banks, reintroduced QE (with no end-date), and cut growth and inflation forecasts.

- Despite the dovish actions of the ECB, the euro posted an outside-up day, trading on both sides of the previous day's range and closing above its high after the ECB announcement.

- The CAD was off nearly 1% on the week after Prime Minister Trudeau called for an election on October 21st and political uncertainty set in.

- Chief Economist and Strategist at Gluskin Sheff & Associates Inc, David Rosenberg, laid out a slew of not-so-rosy Canadian economic data points in the Financial Post that show that the economy is actually sputtering, which should lead to falling rates and currency.

Now, let’s turn to the week ahead.

There is plenty of high frequency data on the calendar this upcoming week: Australian employment; New Zealand GDP; Chinese industrial production, fixed asset investment and retail sales; German ZEW economic sentiment and US industrial production; and Canadian inflation and retail sales.

There are five central bank meetings on the docket next week: US Federal Reserve, Bank of England, Bank of Japan, Swiss National Bank, and Norges Bank (Norway). Of these, only Norway’s central bank is not in the “dovish camp”, since it has raised interest rates three times over the last year. Norway's current deposit rate is at 1.25%, and this week’s meeting could see another quarter point hike - it’s a close call. Meanwhile, there is a 53% chance of a quarter point cut by the Swiss National Bank, especially after the ECB’s latest cut.

Last Tuesday, Reuters reported that BOJ policymakers were less confident about an early pickup in global growth and may be more open to debating additional easing next week. Sources said the BoJ's decision on whether and when to ease will be a close call, and that the conclusion may not come until the last minute. Taking the rates further into negative territory is among options if the BoJ were to ease, but other options are not off the table.

This reporting notwithstanding, the fact that the yen has weakened from a 3-year high over the last three weeks takes the pressure off the BOJ for now.

Now that a “no-deal” Brexit is off the table, PM Johnson and European Commission president Jean-Claude Juncker plan to hold talks at the start of the week to break the impasse. This effectively neuters the Bank of England.

Let’s switch gears and look at the Fed meeting, where the market has completely discounted a quarter point rate cut. However, the recent string of improved economic data points has led the market to scale back another cut before the end of the year. The Tweeter-in-Chief, President Trump, has interjected an element of risk with his propensity to criticise the Fed with his tweets.

If the Fed merely cuts rates by quarter point and refuses to provide a dovish outlook for further cuts, then the USD will go up and so (it seems) will Trump’s temperature.

Key Data Releases This Week

|

Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||