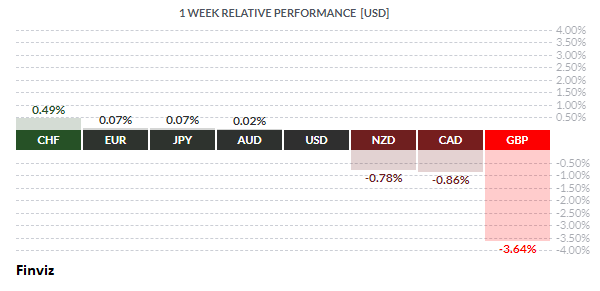

The NZD, CAD, and GBP had the largest percentage move over the last week against the USD. On the end of the spectrum, the countries with negative interest rates outpaced the majors. It is a little counterintuitive: the reason they led was due to carry trade unwind during risk off period. US equity markets were still in correction mode, so any funds that were borrowed for speculative trades were bought back and returned to the lenders. Remember, those lenders offer negative interest rates, so market players borrow from the least expensive places to amplify their speculative bets.

Let’s start with the GBP: we are getting closer to the Brexit end game. The negotiations between the UK and EU are on the verge of collapse as the UK government is declaring its intent to violate their divorce treaty that they agreed to last year. Last Thursday, PM Boris Johnson announced the Internal Markets Bill that would override parts of the Withdrawal Agreement. Remember, the key issue of the divorce is how to extricate the UK from the EU's customs rules while avoiding a hard border between Northern Ireland and the Republic of Ireland. Johnson’s new bill lists several domestic and international laws that it can effectively disregard relating to the movement of goods from Northern Ireland.

The EU said that if the UK adopts the Internal Markets Bill, it will constitute an extremely serious violation of the Withdrawal Agreement and of international law. Even further, they stated that the UK has “seriously damaged trust” and threatened “legal remedies” to address violations of the legal obligations contained in the text if the bill is not amended before month-end. The UK is playing a game of Brexit "chicken", which would end with a so-called hard-Brexit: leaving the EU with no agreement, leaving trade to be administered by WTO rules.

The chart technically shows that the GBP has broken below a rising trend line that has been in place since the March lows and is now testing overlap support at the 1.275 area. A break below 1.275 would put further pressure on the currency down towards 1.25 and possibly 1.2250 by extension.

The USD/CAD rate managed to break above a long-term bearish channel in place since March after WTI Crude prices tumbled $2.86 (-7.19%) to $36.91 in last Tuesday's trading. Crude is down roughly 13% so far this month. I have been calling for a bottom in the USD since mid-August and it looks like the USD/CAD has marked a bottom, for now, at 1.2990. The CAD continued to fall for the rest of the week despite a slight change in the Bank of Canada’s policy language in last week’s policy meeting. The BOC dropped the phrase “it is prepared to take additional measures”, which seems to imply a more optimistic outlook and would be CAD bullish.

With the prospect of further crude weakness and firmer USD demand (due to broader risk aversion during the stock market crash months of September and October and the US election just after that) it would seem that the fundamental landscape beneath USD/CAD has shifted slightly. The USD/CAD pair is free to run as high as the 1.35 level, a move above there would signal the start of a major rebound to the upside for the USD. Of course, a move below the 1.31 level would confirm that the correction is over.

In the week ahead, the central banks from the US, UK, and Japan will be front and centre. What should we expect? If last week’s policy meetings for the Eurozone and Canada are any indication, we should expect them to stay the course.

I suspect that there will be more attention placed on what the Fed has to say, especially after Federal Reserve Chairman Jerome Powell said that the Fed will let inflation run hot at the recent annual Jackson Hole Economic Symposium. My first inclination would be to determine what exactly he means by “hot”. Having said that, with this policy meeting being the last one before the election, I don’t expect anything of consequence to be delivered in order to seem politically impartial. Then again, if the Fed reinforces its dovish stance by adopting an average inflation target, then that may be enough to end the current correction in the USD, clearing the way for a resumption of the bearish downtrend.

Japan’s LDP party will be selecting the successor to Prime Minister Abe this week, who is stepping down for health reasons. Thus, I expect the BOJ meeting to be a non-event.

In the UK, the chaos around Brexit may force the Bank of England to save its monetary bullets for the actual economic fallout caused by a disorderly exit. Look for the central bank to lay the groundwork for additional easing measures.

With children heading back to school, the markets will be on the lookout for possible spikes in the number of new Covid cases. Also, the US Presidential election is less than 2 months away. These factors may encourage risk aversion and put a firm bid in the USD, unless, of course, the FOMC meeting charts a bearish turn.

Trump issued several executive orders relating to this issue, but time will tell if those are sufficient to move the needle.

Also this week: on August 15, US and Chinese officials are due to review the progress of the Phase 1 trade deal. Interestingly, August 15 marks the 49th anniversary of the end of the Bretton Woods system of fixed exchange rates established at the end of World War II. We’ll be watching closely to see what news and market response may come from these meetings.

Key Data Releases This Week

| Forecast | Previous | |||

| WEDNESDAY, SEPTEMBER 16 | ||||

| 07:30 | USD | Core Retail Sales m/m | 1.0% | 1.9% |

| 14:00 | USD | FOMC Economic Projections | ||

| 14:00 | USD | FOMC Statement | ||

| 14:30 | USD | FOMC Press Conference | ||

| 17:45 | NZD | GDP q/q | -12.5% | -1.6% |

| 20:30 | AUD | Employment Change | -40.0K | 114.7K |

| 20:30 | AUD | Unemployment Rate | 7.7% | 7.5% |

| Tentative | JPY | Monetary Policy Statement | ||

| THURSDAY, SEPTEMBER 17 | ||||

| 06:00 | GBP | MPC Official Bank Rate Votes | 0-0-9 | 0-0-9 |

| 06:00 | GBP | Monetary Policy Summary | ||

| 06:00 | GBP | Official Bank Rate | 0.10% | 0.10% |

| FRIDAY, SEPTEMBER 18 | ||||

| 07:30 | CAD | Core Retail Sales m/m | 15.7% | |

Would you like to receive all of our blog posts directly to your inbox? Click here to subscribe!

|

by Tony Valente Senior FX Dealer, Global Treasury Solutions |

|||