Known Unknowns

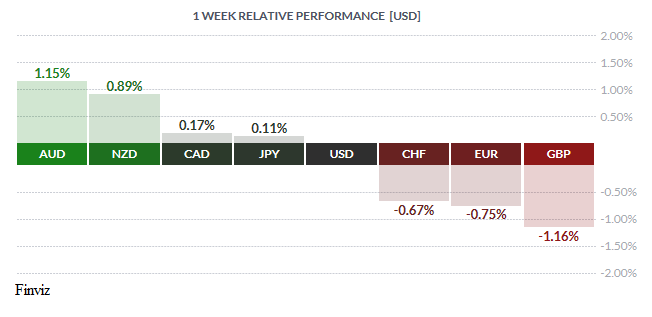

It’s no wonder President Donald Trump rages about fake news. All we heard about last week was how we all had to get ready for “Super Thursday” - the ECB meeting, the James Comey testimony, and the UK election. Call it fake news or media sensationalism but “Super Thursday” turned out to be a real dud. In reality, due to “unnamed sources” at the ECB, the release of Comey’s prepared remarks on Wednesday, and several UK election polls the outcomes on Thursday were known unknowns. As you can see in the relative performance chart, the currencies from the countries that were not involved in Thursday’s events benefited the most against the currencies from the countries that were, mainly the USD, EUR, and GBP. Let’s drill down on each event and see how the currencies reacted.

The ECB meeting played out as expected with only some minor changes. They did not announce any policy changes but they did upgrade their GDP forecasts, altered their risk assessment, and dropped the word “lower rates” from their forward guidance. In other words, they did what the Fed is famous for – make little tweaks to forward guidance when you don’t want to signal any change to outlook. The bottom line is that this game of words is not hawkish but it isn’t exactly dovish either; and that’s why the euro didn’t fall much in reaction. A taper of the ECB’s bond buying is only a matter of time and this will always be on the back of trader’s minds

The Senate testimony by former FBI Director James Comey was very disappointing to the Trump haters. The two things that stood out were that Comey himself leaked his memos to the media, but he didn’t do it directly, he instead gave them to friend of his to do so. The end result is that President Trump did not officially do anything to warrant an impeachment and that he was never under investigation or linked to the so called Russian hacking scandal. Honestly, there has been so many leaks to the media, some true some false, that the most important thing that someone should have leaked was that the President of the United States of America wasn’t under investigation and the fact that it wasn’t speaks volumes about this whole mess. The end result is that this was a positive for the US and the dollar reacted favourably as you can see its rise against the yen since the Wednesday’s release of Comey’s prepared remarks.

The truly unknown was the UK election. It was a known unknown because the winner of the election was never in doubt. The only unknowable element was would Prime Minister May lose her parliamentary majority. The answer to that is yes. She didn’t need to call the election but she did and it blew up in her face. Now she needs to find a coalition partner to work with and most importantly, she made the negotiations with Brussels over the Brexit divorce more complicated, if they can happen at all - how can you deliver Brexit when you don’t have any negotiating authority and no majority in the House of Commons? The pound dropped by over 2% and is now at its weakest level in 6 weeks and the worst may be yet to come.

The truly unknown was the UK election. It was a known unknown because the winner of the election was never in doubt. The only unknowable element was would Prime Minister May lose her parliamentary majority. The answer to that is yes. She didn’t need to call the election but she did and it blew up in her face. Now she needs to find a coalition partner to work with and most importantly, she made the negotiations with Brussels over the Brexit divorce more complicated, if they can happen at all - how can you deliver Brexit when you don’t have any negotiating authority and no majority in the House of Commons? The pound dropped by over 2% and is now at its weakest level in 6 weeks and the worst may be yet to come.

Next week is the all-important Federal Reserve meeting. There is no doubt in the market’s mind that the Fed will raise interest rates at this meeting, as Fed members have done nothing to cast doubt on those expectations. The only unknown is will they hike again in 2017. The recent spate of soft economic data, including the very soft employment data, has caused the market to cut the chance of another hike this year to 42%. It the market’s thinking is collaborated with the Fed’s message then this week’s hike would by a dovish hike and the USD would continue to weaken. We say that the USD could weaken because the lack of additional rate hikes may be replaced with the rolling off bonds from the Fed’s balance sheet which would in effect tighten financial conditions. On the other hand, if the Fed’s announcement and message does not cast doubt on any additional rate hike(s) this year then the USD will most surely advance since it is the only major central bank raising rates. Whatever position you are hoping for, keep in mind that the USD will come under some pressure prior to the meeting. The PPI, CPI, and retail sales report will all be released prior to the Fed meeting and will probably add to the market’s anxiety about the performance of the US economy.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, JUNE 12 | ||||

| TUESDAY, JUNE 13 | ||||

| 04:30 | GBP | CPI y/y | 2.7% | 2.7% |

| 08:30 | USD | PPI m/m | 0.0% | 0.5% |

| 22:00 | CNY | Industrial Production y/y | 6.4% | 6.5% |

| WEDNESDAY, JUNE 14 | ||||

| 04:30 | GBP | Average Earnings Index 3m/y | 2.4% | 2.4% |

| 08:30 | USD | CPI m/m | 0.2% | 0.2% |

| 08:30 | USD | Core CPI m/m | 0.2% | 0.1% |

| 08:30 | USD | Core Retail Sales m/m | 0.2% | 0.3% |

| 08:30 | USD | Retail Sales m/m | 0.1% | 0.4% |

| 10:30 | USD | Crude Oil Inventories | 3.3M | |

| 14:00 | USD | FOMC Economic Projections | ||

| 14:00 | USD | FOMC Statement | ||

| 14:00 | USD | Federal Funds Rate | <1.25% | <1.00% |

| 14:30 | USD | FOMC Press Conference | ||

| 18:45 | NZD | GDP q/q | 0.7% | 0.4% |

| 21:30 | AUD | Employment Change | 9.7K | 37.4K |

| 21:30 | AUD | Unemployment Rate | 5.7% | 5.7% |

| THURSDAY, JUNE 15 | ||||

| 03:30 | CHF | Libor Rate | -0.75% | -0.75% |

| 03:30 | CHF | SNB Monetary Policy Assessment | ||

| 03:30 | CHF | SNB Press Conference | ||

| 04:30 | GBP | Retail Sales m/m | -0.9% | 2.3% |

| 07:00 | GBP | MPC Official Bank Rate Votes | 1-0-7 | 1-0-7 |

| 07:00 | GBP | Monetary Policy Summary | ||

| 07:00 | GBP | Official Bank Rate | 0.25% | 0.25% |

| 08:30 | USD | Unemployment Claims | 241K | 245K |

| 16:00 | GBP | BOE Gov Carney Speaks | ||

| Tentative | JPY | Monetary Policy Statement | ||

| FRIDAY, JUNE 16 | ||||

| Tentative | JPY | BOJ Policy Rate | -0.10% | -0.10% |

| 02:30 | JPY | BOJ Press Conference | ||

| 08:30 | USD | Building Permits | 1.25M | 1.23M |

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |

|

by FRED MAURER Senior FX Dealer, Global Treasury Solutions |