Policy Cocktail

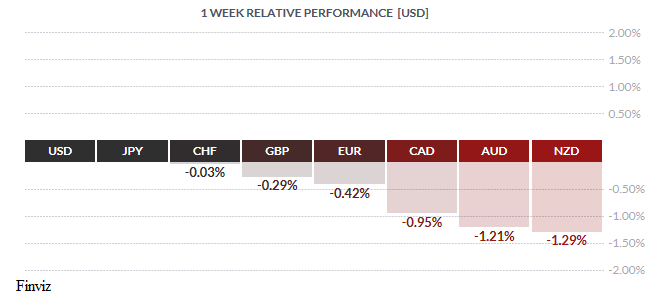

The worst performing currencies last week were the Australian and New Zealand dollars as both managed to make 2-year lows. China/US trade tensions and Chinese Yuan weakness are weighing on both currencies. For Australia specifically, the game-changer was a mortgage rate hike by Westpac, one of Australia’s big four banks, at a time when Australia’s central bank, Reserve Bank, has kept the cash rate at a steady 1.5% for two years. This out-of-cycle rate hike was rare and it is a flashing red signal of increased stress in Australia’s bloated $1.6tn mortgage market. News reports on Friday that President Trump is eyeing Japan, another trading partner of both Australia and New Zealand, as the next Asian target in the trade war added to the weekly downfall of the AUD and NZD and drove flows to the safe-haven yen. James Freeman, assistant editor of The Wall Street Journal's editorial page, wrote that President Trump seemed to be still bothered by the terms of US trade with Japan. Trump described his closeness with Japanese Prime Minister Shinzo Abe, but added: "Of course that will end as soon as I tell them how much they have to pay."

Speaking of trade tensions, when Trump started his trade war crusade the conventional wisdom being bandied about was that protectionism is supposed to be bad for a currency. Thus far, the opposite is true as the USD is at its strongest level in over a year. Let’s explore the factors that have helped the USD move higher.

The most obvious factor is the economy. It is safe to say that Trump started the trade war from a position of strength. The US economy is doing well with a healthy labour market, strong equity markets, and help from the government. The government has provided fiscal stimulus (by way of tax reform), spending increases, and pro-business deregulation. Thus, the government is employing a loose fiscal policy mandate.

In terms of monetary policy, the US is the only country that is raising interest rates on a consistent basis. Not only that, but the rolling off of the Federal Reserve’s balance sheet (aka quantitative tightening) is the equivalent of interest rate hikes in itself. Therefore, the policy cocktail of tight monetary policy and loose fiscal policy is the elixir for a stronger USD.

The consequence of a strong USD only encourages more strength and this can be seen in the developing crisis in emerging market currencies. Most emerging market countries borrow money in USD only. As the USD rises, it makes it more costly for those countries to service their debt. This is exactly what is happening in Argentina, Turkey, Indonesia, and South Africa. Also, for investors in those countries, they begin to liquidate their investment and look for alternatives and right now, the best alternative is the safety of USD.

The Bank of Canada was in the spotlight last week. The BOC chose to stand pat at its policy meeting on Wednesday, which the market fully expected. The central bank cited the uncertainty around NAFTA as the key factor of its decision. However, what was unexpected was the idea that the bank had actually debated dropping the line “gradual approach” to rate hikes from their policy statement. Bank of Canada Senior Deputy Governor Carolyn Wilkins, in a speech to the Saskatchewan Trade & Export Partnership, acknowledged this fact and also added that normally there would be a rise in interest rate at this point to pre-empt inflation.

Canada has been renegotiating NAFTA with the US and Mexico for the last 13 months and as much as Trump would have you believe, there is no immediate deadline to reach a new agreement.The President cannot just unilaterally cancel NAFTA or exclude Canada from it, he needs Congress to put either into effect, and Congress is unlikely to cooperate. In fact, if the new Congress goes to the Democrats in the fall elections then the advantage may swing to the Canadians since it was President Clinton and his Democrats that signed NAFTA into law on December 8, 1993. It is also worth remembering that cancelling NAFTA would not be the end of the trading relationship, after all the two countries traded with each other for over 100 years before there was an agreement.

Lastly, we may be on the infancy of a 21st century Viking revival. The Vikings were romanticised as noble savages for raiding and conquering Northern Europe in the 10th century. Today in Sweden, the anti-immigrant party, Sweden Democrats, is set to make gains in Sunday’s election. The influx of over 163K asylum seekers in 2015 has polarised voters and could give the new party a veto over which parties form the next government. By the way, the Swedish krona is the weakest of the major currencies so far this year, down about 10% against the USD. Politics has had a contributing factors but not the main one that belongs to the central bank. The Riksbank still employs negative interest rates of -0.50%. At their policy meeting last week, they kept rates unchanged as expected but they still want to raise rates soon. What is their definition of “soon” - in either December or February from their previous proclamation of “definitely by year end”. It’s hard to believe that they still feel the need for emergency policy measures.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, SEPTEMBER 10 | ||||

| 04:30 | GBP | GDP m/m | 0.2% | 0.1% |

| GBP | Manufacturing Production m/m | 0.2% | 0.4% | |

| TUESDAY, SEPTEMBER 11 | ||||

| 04:30 | GBP | Average Earning Index 3m/y | 2.5% | 2.4% |

| WEDNESDAY, SEPTEMBER 12 | ||||

| 08:30 | USD | PPI m/m | 0.2% | 0.0% |

| 10:30 | USD | Crude Oil Inventories | -4.3M | |

| 21:30 | AUD | Employment Change | 18.4K | -3.9K |

| AUD | Unemployment Rate | 5.3% |

5.3% | |

| THURSDAY, SEPTEMBER 13 | ||||

| 07:00 | GBP | MPC Official Bank Rate Votes | 0-0-9 | 9-0-0 |

| GBP | Monetary Policy Summary | |||

| GBP | Official Banks Rate | 0.75% | 0.75% | |

| 07:45 | EUR | Main Refinancing Rate | 0.00% | 0.00% |

| 08:30 | EUR | ECB Press Conference | ||

| USD | CPI m/m | 0.3% | 0.2% | |

| USD | Core CPI m/m | 0.2% | 0.2% | |

| FRIDAY, SEPTEMBER 14 | ||||

| 06:00 | GBP | BOE Gov Carney Speaks | ||

| 08:30 | USD | Core Retail Sales m/m | 0.5% | 0.6% |

| USD | Retail Sales m/m | 0.4% | 0.5% | |

|

by TONY VALENTE Senior FX Dealer, Global Treasury Solutions |