Don't Fight the Fed

FinViz

Market players quickly learn some pithy aphorisms to guide them in day-to-day dealing in the capital markets: “the trend is your friend”, “buy the rumour, sell the fact”, and (our favourite) “buy on mystery, sell on history".

Experienced traders generally follow these simple rules, although they sometimes ignore them – being a contrarian can be profitable too. But there is one rule that all traders obey and rarely, if ever, contravene: “don’t fight the Fed”. That became clear, if it was ever in doubt, following remarks by Federal Reserve chief Jay Powell to both the House and Senate banking committees last week. There were other developments this week, as well, so let’s take a look.

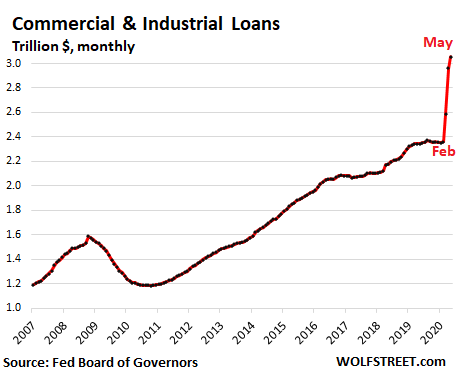

In his remarks to Congress last week, Fed chair Jay Powell said little that was unexpected, but did make clear that the Fed will do whatever is necessary to support the economy during its recovery from the COVID-19 crisis. Among other things: “keeping its foot on the gas” through the epidemic and going full speed ahead on asset purchases. With reference to the latter, last Monday the Fed announced it would commence its programme of corporate bond buying, first mooted in March, of up to 250.0 bil of investment grade (AAA to BBB-) bonds. According to this chart, there’s plenty of product out there for the Fed to buy:

Mr. Powell said that “FOMC members are not even thinking about raising rates”, while making abundantly clear that negative rates are not on the table. Given the mixed success of negative rates in Europe and Japan, this is likely a prudent course.

Bottom Line: The Fed has plenty of firepower and lots of ammunition in reserve. Only a fool would get in the way of a Federal Reserve determined to keep interest rates low and the economy liquid, filling the gaping holes in personal and corporate balance sheets.

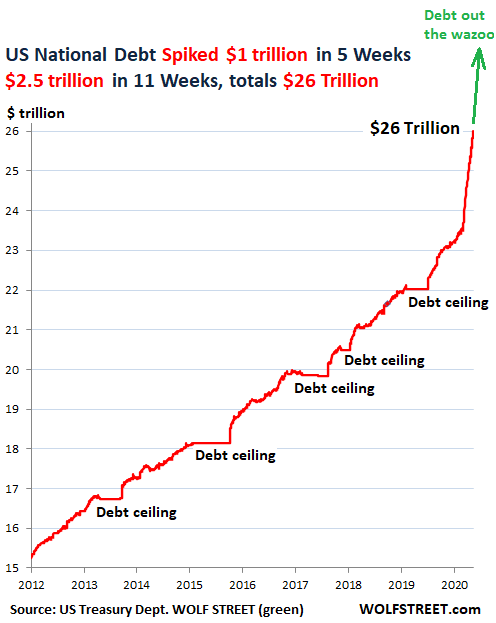

So much for monetary policy. Just how awful is fiscal policy these days or, in other words, how much does Uncle Sam now owe?

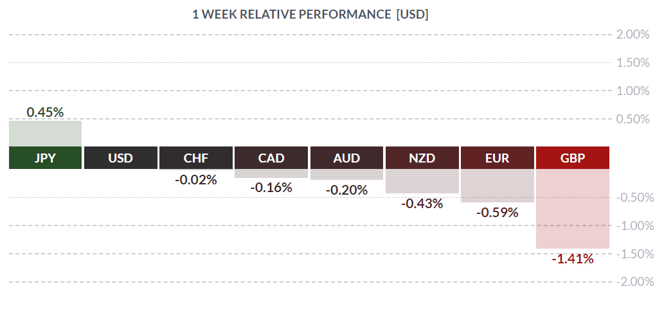

Still, the greenback was the near-winner on the week, trailing only JPY. Such uncontrolled debt creation should be a negative for the USD, but other countries – such as the EU and especially Japan - are in worse shape. Japan has been struggling for decades now, with colossal government debts and negative interest rates and, aside from shiny new high-speed train stations in every hamlet, little to show for it. In the Eurozone, the ECB is keeping rates low to support an exceptionally fragile banking sector whereas, by contrast, the American (and Canadian) banking sectors are strong and well-capitalised.

What A Difference A Month Makes

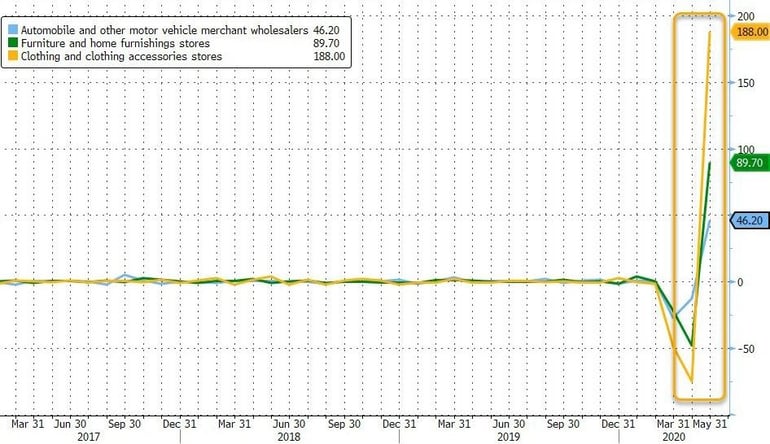

Both Canada and the US released Retail Sales statistics last week, Canada for April and America for May. Quite the divergence! In April, Canada reported a decline of -26.4% vs the call of -15.1%, while Statscan put out a flash estimate for May of +19.1%, indicating that April may very well have been the nadir for Canada’s domestic economy. That appears to have been the case Stateside, where May Retail Sales jumped a record +17.7%, trashing the consensus call of +8.0% following the April decline of -14.7%. Notably, Bank of America’s credit card tracker reported upticks in restaurants, airlines, and home furnishings.

So, have we passed the worst? Are we in recovery mode yet? Incoming Bank of Canada governor Tiff MacKlem testified to MPs in Parliament this past week and made quite clear the BOC’s outlook:

“Some day we will get through this, the economy will be recovered, and interest rates will start to move back to more normal levels […] But we're in a deep hole, and it's going to be a long way out of this hole."

That largely states the obvious. However, Mr. MacKlem had an upbeat assessment for Q3, saying he expected to see some good numbers as more people returned to work and hours were lengthened. Earlier this month the Bank had held rates steady at 0.25% and acknowledged the Canadian economy had apparently avoided the worst-case scenario set out by the Bank’s research team

.In other remarks to MPs, Mr. MacKlem noted difficulties with the Consumer Price Index and its growing inaccuracy. Shopping and purchasing habits have changed over the years and the Bank, along with Statistics Canada, is working on a revised, more current measure of consumer inflation.

Deputy Governor Lawrence Schembri, in a speech elsewhere to a business audience, said the coming economic recovery would be slow and uneven.

“The uncertainty around this recuperation stage is extraordinary and points toward a recovery that will be gradual and long-lasting as this uncertainty slowly dissipates."

CAD moved very little on these remarks, continuing to trade in its current range.

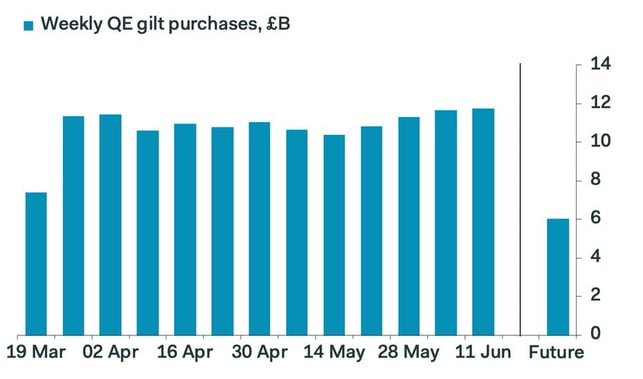

The Bank of England held rates steady at 0.1% as expected while, in a surprise and somewhat hawkish move, increased its bond-buying programme by just 100.0 bil GBP – half the anticipated amount. Translation: reduced bond purchases will see bond yields rise somewhat, sending a signal to market players that the BOE pandemic response is now tapering. Sterling bounced higher on the news, then settled back and ended up the loser on the week, as investors apparently chased higher yields elsewhere.

The coming week sees no statistics in Canada, while America has a slew of metrics released late in the week along with a dash of Fedspeak.

Key Data Releases This Week

| Forecast | Previous | |||

| MONDAY, JUNE 22 | ||||

| 10:00 | CAD | BOC Gov Macklem Speaks | ||

| TUESDAY, JUNE 23 | ||||

| 02:15 | EUR | French Flash Services PMI | 44.9 | 31.1 |

| 02:30 | EUR | German Flash Manufacturing PMI | 41.5 | 36.6 |

| 02:30 | EUR | German Flash Services PMI | 41.7 | 32.6 |

| 21:00 | NZD | Official Cash Rate | 0.25% | 0.25% |

| 21:00 | NZD | RBNZ Rate Statement | ||

| WEDNESDAY, JUNE 24 | ||||

| THURSDAY, JUNE 25 | ||||

| FRIDAY, JUNE 26 | ||||

|

by DAVID B. GRANNER Senior FX Dealer, Global Treasury Solutions |

|||